As such, when looking at the stock of a particular company, it is more useful to evaluate the P/E ratio of that company against the industry average rather than the market average. The industry of the company, the state of the overall market, and the investor’s own interpretation can all affect how they evaluate a particular P/E ratio. The ever popular one-page Snapshot reports are generated for virtually every single Zacks Ranked stock. It’s packed with all of the company’s key stats and salient decision making information.

Diluted Earnings Per Share Calculation (EPS)

ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities. You can also look back at history and see where the stock’s average P/E ratio has been and whether the current P/E is at a premium or a discount, Yoshioka says. The P/E ratio is one of the simpler tools to use when it comes to stock analysis, but there are some drawbacks to be aware of. However, PE ratios aren’t foolproof signals of when to buy and sell stocks. They can indicate a wide variety of things and should be used with other stock research techniques.

- Forward PE Ratio is a difficult task as it considers dividing the current share price by the projected earnings per share over the next four quarters.

- A company with a current P/E ratio of 25, which is above the S&P average, trades at 25 times its earnings.

- Relative P/E compares the current absolute P/E to a benchmark or a range of past P/Es over a set time period such as the last 5 years.

- To get a better understanding of this, explore the following tool, which looks at a hypothetical stock and how its price movements and changes in earnings affect PE ratio.

Trailing vs. Forward P/E Ratio: What is the Difference?

Researching stocks has never been so easy or insightful as with the ZER Analyst and Snapshot reports. An industry with a larger percentage of Zacks Rank #1’s and #2’s will have a better average Zacks Rank than one with a larger percentage of Zacks Rank #4’s and #5’s. There’s also a VGM Score (‘V’ for Value, ‘G’ for Growth and ‘M’ for Momentum), which combines the weighted average of the individual style scores into one score. To obtain the EPS number of a public company, the analyst needs to access its published income statement. Public companies generally report this number at the bottom of their income statement, below the net income line.

What Is a P/E Ratio and How Do I Use It in Investing?

Other than that, it’s hard to gain any insight into the stock from the P/E ratio alone. We would need to make historical comparisons to what P/E the company has had in the past and look at the P/E of the company’s competitors. In addition, investors should keep in mind that the trailing P/E ratio (the most widely used form) is based on past data and there is no guarantee that earnings will remain the same. There is also a potential danger that accounting figures have been manipulated to create misleading earnings reports. When using a P/E ratio based on projected earnings (a forward P/E) there is a risk that estimates are inaccurate.

What does a negative P/E ratio mean?

If the forward P/E ratio is higher than the current P/E ratio, it indicates that analysts expect the company’s earnings to decrease in the future. However, these estimates aren’t always accurate and can be subject to revisions. The detailed multi-page Analyst report transactions does an even deeper dive on the company’s vital statistics. It also includes an industry comparison table to see how your stock compares to its expanded industry, and the S&P 500. To derive the PE ratio, the current stock price is divided by the earning per share.

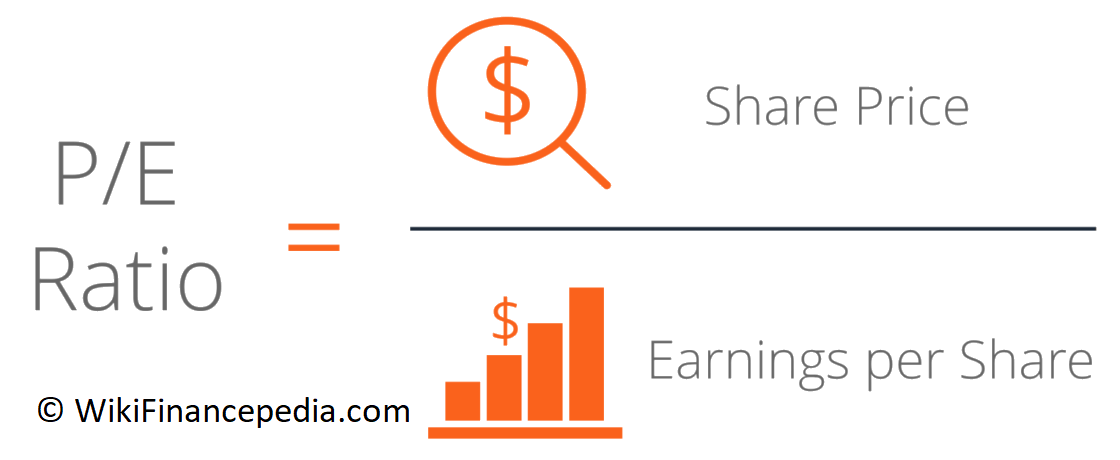

The P/E ratio should be compared with the share market as a whole, focusing on other companies in the same industry as well as the same company over the last few years. To calculate the P/E ratio, compute the market value per share divided by the company’s earnings per share. In this way, some believe that the PEG Ratio is a more accurate measure of value than the P/E ratio. It is more complete because it adds expected earnings growth into the calculation.

A PEG greater than one might be considered overvalued because it suggests the stock price is too high relative to the company’s expected earnings growth. The P/E ratio also helps investors determine a stock’s market value compared with the company’s earnings. That is, the P/E ratio shows what the market is willing to pay today for a stock based on its past or future earnings. A high P/E ratio could signal that a stock’s price is high relative to earnings and is overvalued.

In addition, the ratio can also be interpreted as the amount of time (typically years) over which the company would need to sustain its current earnings to pay back the current share price. The CAPE ratio is often used to gauge market cycles, helping investors identify potential bubbles or periods of undervaluation. A high CAPE ratio might suggest that the market is overpriced relative to its historical earnings, while a low CAPE ratio could indicate the opposite. This provides a snapshot of how willing investors have been to buy the stock based on real performance during the past year. The limitation is that future growth prospects could change, and trailing P/E does not consider this.

Consequently, based on the Price-Earnings ratio analysis alone–everything being equal–it would be a no-brainer to invest into Company B that is cheaper with higher EPS. If the current or absolute P/E ratio is lower than the past or benchmark P/E value, the relative P/E has a value below 100%–and vice versa. The inherent limitation of the forward P/E ratio is that the metric is based on the opinions of the person making the predictions and so earnings may be under/over-estimated, whether on purpose or not. For example, let’s compare two companies, Company A and Company B, and assume they are both in the tech sector.

The P/E ratio, often referred to as the “price-earnings ratio”, measures a company’s current stock price relative to its earnings per share (EPS). The trailing P/E ratio uses earnings per share from the past 12 months, reflecting historical performance. In contrast, the forward P/E ratio uses projected earnings for the next 12 months, incorporating future expectations. Forward P/E is often used to gauge investor sentiment about the company’s growth prospects while trailing P/E provides a snapshot based on actual past performance.

The P/E ratio helps investors determine the market value of a stock compared with the company’s earnings. It shows what the market is willing to pay for a stock based on its past or future earnings. A high P/E ratio generally means that investors are willing to pay a premium for the company’s earnings, often because they expect the company to continue growing in the future. It suggests that the market has high confidence in the company’s potential to increase profits over time. However, a high P/E ratio can also signal that a stock may be overvalued, meaning the share price could have gotten ahead of itself compared to other companies in the same industry.